Your financial future is one of the most important aspects of your life. It encompasses your ability to save, invest, plan for retirement, and achieve your financial goals. But the world of finance can be complex and overwhelming, with countless options and advice available. When it comes to deciding who to trust with your financial future, it is essential to be informed, cautious, and strategic.

Choosing the right person or institution to manage or advise on your money can profoundly impact your financial well-being. But how do you know who deserves your trust? What credentials, qualities, and ethical standards should you look for? This article aims to guide you through the crucial factors to consider when deciding who to entrust with your financial future.

Key Takeaways

- Trust is foundational for financial planning success.

- Always verify credentials, especially CFP designation.

- Prefer fiduciaries who legally act in your best interests.

- Transparency about fees and risks is a must.

- Experience and ethical reputation matter greatly.

- Robo-advisors are useful but limited in scope.

- Never hesitate to switch advisors if trust is compromised.

- Ask critical questions and maintain ongoing communication.

Understanding Financial Trust: Why It Matters

Trust in finance goes far beyond a simple feeling of comfort or confidence—it forms the very bedrock of all financial decision-making and planning. When you entrust someone with your financial future, whether it’s a financial advisor, planner, or institution, you are essentially relying on their expertise, judgment, and integrity to guide decisions that can significantly affect your life’s security and prosperity.

The Multifaceted Nature of Financial Trust

Financial trust is built on several critical pillars:

- Competence and Ability: You need confidence that the person managing or advising on your money has the technical knowledge and skills required. This includes understanding complex financial products, tax laws, market behavior, and retirement strategies.

- Integrity and Ethics: Beyond competence, integrity means acting honestly and ethically at all times, placing your interests above their own. Trustworthy advisors do not hide information, manipulate data, or push products simply for commissions.

- Transparency and Communication: Financial advisors who openly share their fee structures, risks, and the rationale behind recommendations foster trust. Transparent communication helps you understand what is happening with your money and why certain decisions are made.

- Alignment with Your Best Interests: True financial trust involves confidence that the advisor is working to meet your personal goals and circumstances, not a generic sales quota or product promotion.

Why Trust is Especially Critical in Finance

Money is deeply personal and often tied to your dreams, security, and legacy. Because financial markets can be volatile and the landscape of investment options is broad and complex, having a trusted guide is essential to navigating these uncertainties successfully.

When you trust your financial advisor, you’re not just handing over numbers; you’re trusting them with your:

- Retirement plans

- Children’s education funds

- Debt management strategies

- Estate planning

- Daily financial health

This means that any breach of trust or poor advice can have serious repercussions—potentially affecting your standard of living, ability to retire comfortably, or even your family’s future.

Risks of Lacking Trust

Without a foundation of trust, several dangers arise:

- Poor Advice: You may receive recommendations that prioritize the advisor’s commissions or relationships over your financial health.

- Hidden Fees: Lack of transparency can lead to unexpected charges, eroding your investment returns.

- Conflicts of Interest: Advisors who don’t act as fiduciaries may push products that benefit them more than you.

- Emotional Stress: Uncertainty about your advisor’s motives can cause anxiety and make you hesitant to engage fully in your financial planning.

- Missed Opportunities: Distrust may lead you to avoid professional help altogether, resulting in missed chances for growth or tax efficiency.

The Positive Impact of Financial Trust

Conversely, when trust exists, the relationship becomes a powerful partnership. You can:

- Collaborate openly on your goals and concerns.

- Feel confident in long-term plans even during market fluctuations.

- Benefit from tailored advice aligned with your values.

- Achieve better financial outcomes through informed decisions.

- Gain peace of mind knowing your advisor is accountable and transparent.

Building Trust Takes Time

It’s important to remember that trust is not given lightly nor is it instantaneous. It develops through consistent behavior over time—through honest conversations, demonstrated expertise, and mutual respect.

In essence, financial trust is a two-way street: while you must verify credentials and intentions, a trustworthy advisor will also earn your trust through their actions, professionalism, and commitment to your financial success.

The Consequences of Poor Trust

Misplaced trust can lead to:

- Financial scams and fraud

- Excessive fees and commissions

- Inappropriate investment advice

- Poor financial planning leading to missed goals

- Loss of financial independence

Therefore, understanding who to trust and how to evaluate trustworthiness is crucial.

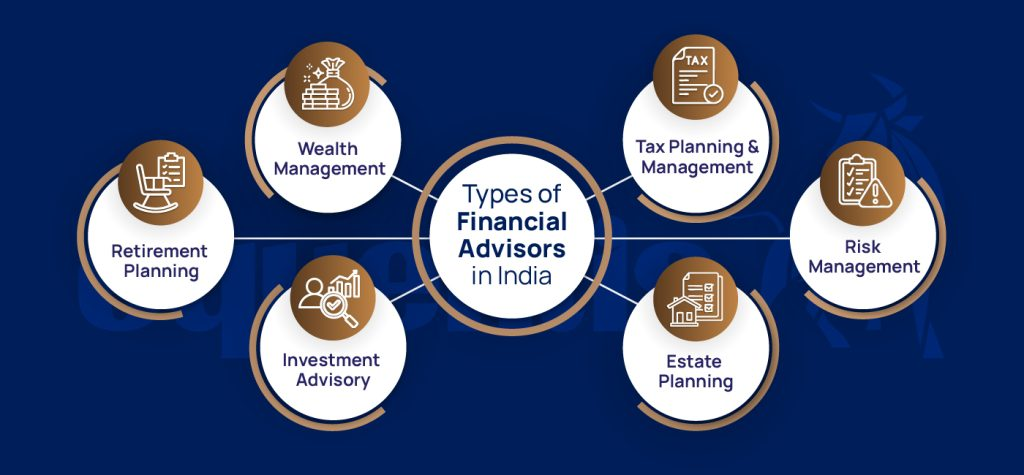

Types of Financial Professionals

Before diving into how to trust someone, it’s essential to know the types of professionals who might manage or advise on your finances:

- Financial Advisors/Planners: Help with comprehensive financial planning, investment strategies, retirement planning, tax strategies, and estate planning.

- Certified Financial Planners (CFPs): Hold a CFP certification, indicating a standardized and rigorous education and ethical code.

- Investment Advisors: Focus on managing your investment portfolio.

- Brokers: Execute buy and sell orders for securities on your behalf, often earning commissions.

- Accountants/CPAs: Handle taxes, bookkeeping, and sometimes financial advice.

- Bankers: Offer banking products and sometimes investment products.

- Robo-Advisors: Automated platforms providing algorithm-based portfolio management.

Each has different roles, incentives, and standards—understanding these distinctions helps you choose wisely.

Key Qualities to Look for When Choosing Who to Trust

1. Credentials and Qualifications

- Certified Financial Planner (CFP®): Recognized globally as a mark of professionalism. CFPs have undergone comprehensive training, passed rigorous exams, and must adhere to ethical standards.

- Chartered Financial Analyst (CFA): Emphasizes investment management expertise.

- Certified Public Accountant (CPA): Useful for tax planning and accounting needs.

- Registered Investment Advisor (RIA): Fiduciaries registered with the SEC or state regulators, legally bound to put your interests first.

Credentials demonstrate knowledge and a commitment to professional standards.

2. Fiduciary Duty

A fiduciary is legally obligated to act in your best interests, rather than their own or their company’s. Fiduciary advisors avoid conflicts of interest and disclose fees transparently.

- Ask if the advisor is a fiduciary at all times.

- Beware of brokers who may only need to meet suitability standards, which are less strict.

3. Transparency and Communication

Trustworthy advisors communicate clearly about:

- Fees and compensation structures

- Investment strategies and risks

- Progress updates and reporting

They answer your questions patiently and provide understandable explanations.

4. Experience and Track Record

Look for professionals with years of experience and a positive track record. Verify their history with regulatory bodies like FINRA’s BrokerCheck or the SEC’s Investment Adviser Public Disclosure database.

5. Compatibility and Personal Rapport

Financial planning is personal. Your advisor should understand your goals, risk tolerance, and values. Trust grows from good communication and genuine care.

6. Ethical Reputation

Search for any disciplinary actions or complaints. Check online reviews and ask for references.

7. Fee Structure

Understand how your advisor is compensated. Fee-only advisors typically have fewer conflicts of interest than commission-based ones.

How to Evaluate and Vet Financial Professionals

Step 1: Verify Credentials

Use official databases like:

- CFP Board website

- FINRA BrokerCheck

- SEC’s Investment Adviser Public Disclosure

Step 2: Interview Multiple Advisors

Prepare questions about:

- Their fiduciary status

- Fee structures

- Investment philosophy

- Experience with clients like you

Step 3: Check References and Reviews

Ask for client references or testimonials.

Step 4: Understand Fee Structures

Clarify:

- Hourly fees

- Percentage of assets under management (AUM)

- Commissions

- Flat fees

Step 5: Review Contract and Agreements Carefully

Make sure you understand termination clauses, services included, and obligations.

The Role of Technology and Robo-Advisors

In recent years, robo-advisors have emerged as an alternative to traditional financial advisors. These platforms use algorithms to manage portfolios and provide financial advice.

Advantages

- Lower fees

- Accessibility

- Automation and ease of use

Limitations

- Lack of personalized human advice

- Limited ability to handle complex situations

- Cannot provide emotional support during market volatility

Robo-advisors can be trustworthy for simple portfolios but may not be ideal for comprehensive planning.

ReRed Flags to Watch Out For

Choosing a financial advisor or institution without vigilance can lead to costly mistakes. There are several warning signs—red flags—that indicate you should proceed with caution or reconsider your choice altogether. Recognizing these red flags early can protect your financial future from mismanagement, fraud, or simply poor advice.

1. Promises of Guaranteed High Returns

One of the most glaring red flags is any promise or guarantee of high returns with little or no risk. The financial markets are inherently unpredictable; no legitimate advisor can guarantee profits or specific outcomes.

- Why it’s a red flag: High returns usually come with higher risks. Guarantees are often used to lure unsuspecting investors into risky or fraudulent schemes.

- What to do: Always question any promise that sounds too good to be true. Ask for historical data and independent verification, but remember, past performance is no guarantee of future results.

2. Pressure Tactics or Rushed Decisions

If an advisor pressures you to make quick decisions or discourages you from taking time to think or seek a second opinion, be wary.

- Why it’s a red flag: Ethical advisors respect your decision-making process and understand that major financial decisions require time and due diligence.

- Examples: Urgency to invest immediately, “limited-time offers,” or discouraging questions.

- What to do: Take your time, ask for written materials, and don’t hesitate to say no or walk away.

3. Lack of Transparency About Fees or Strategies

Advisors who are vague or evasive about their fees, commissions, or investment strategies should raise concern.

- Why it’s a red flag: Hidden fees can erode your returns, and unclear strategies mean you don’t fully understand how your money is managed.

- What to do: Request a clear, written fee disclosure. Ask how and when they get paid, and request detailed explanations of their investment approach.

4. Refusal to Sign a Fiduciary Oath

A fiduciary is legally bound to act in your best interest. Advisors who refuse to commit to this standard may have conflicting incentives.

- Why it’s a red flag: Without a fiduciary commitment, advisors may prioritize their commissions or employer’s products over your needs.

- What to do: Ask explicitly if they act as fiduciaries at all times. If not, consider looking elsewhere.

5. Conflicts of Interest Not Disclosed

Hidden conflicts of interest can compromise the advice you receive.

- Why it’s a red flag: If an advisor profits from selling specific products or has relationships with certain financial institutions, their recommendations might be biased.

- Examples: Steering you toward proprietary mutual funds with high fees or incentivized insurance products.

- What to do: Demand full disclosure of any potential conflicts and evaluate if their advice remains objective.

6. Lack of Credentials or Verifiable History

Advisors without recognized certifications or a verifiable professional background may lack the necessary expertise or could be untrustworthy.

- Why it’s a red flag: Credentials are a signal of competence and adherence to ethical standards. Lack of verifiable history means you can’t check for past complaints or disciplinary actions.

- What to do: Verify credentials with official organizations like the CFP Board or FINRA BrokerCheck. Avoid anyone unwilling or unable to provide references or proof of qualifications.

7. Overly Complex or Secretive Strategies

If an advisor uses overly complicated jargon, complex investment products without clear explanations, or secrecy around how your money is managed, be cautious.

- Why it’s a red flag: This may be an attempt to confuse you into agreeing or hide risky or unsuitable investments.

- What to do: Demand simple, understandable explanations. A good advisor educates and empowers you, not intimidates you.

8. History of Regulatory or Legal Issues

Past disciplinary actions, lawsuits, or regulatory sanctions are serious warnings.

- Why it’s a red flag: These issues can indicate unethical behavior, fraud, or incompetence.

- What to do: Use tools like FINRA BrokerCheck or the SEC’s Investment Adviser Public Disclosure database to research any professional you’re considering.

9. Lack of Clear Written Agreements

Advisors who do not provide detailed, written agreements outlining their services, fees, and your rights may be hiding unfavorable terms.

- Why it’s a red flag: Without clear contracts, you lack protection and clarity about what you are agreeing to.

- What to do: Always insist on a written contract before transferring any assets or money.

10. Overemphasis on Sales and Product Pitches

If an advisor spends most of the time selling products rather than listening and providing customized advice, be wary.

What to do: Look for advisors who focus on your goals and tailor strategies accordingly, rather than pushing specific products.

Why it’s a red flag: Financial advice should be client-centric, not product-centric.

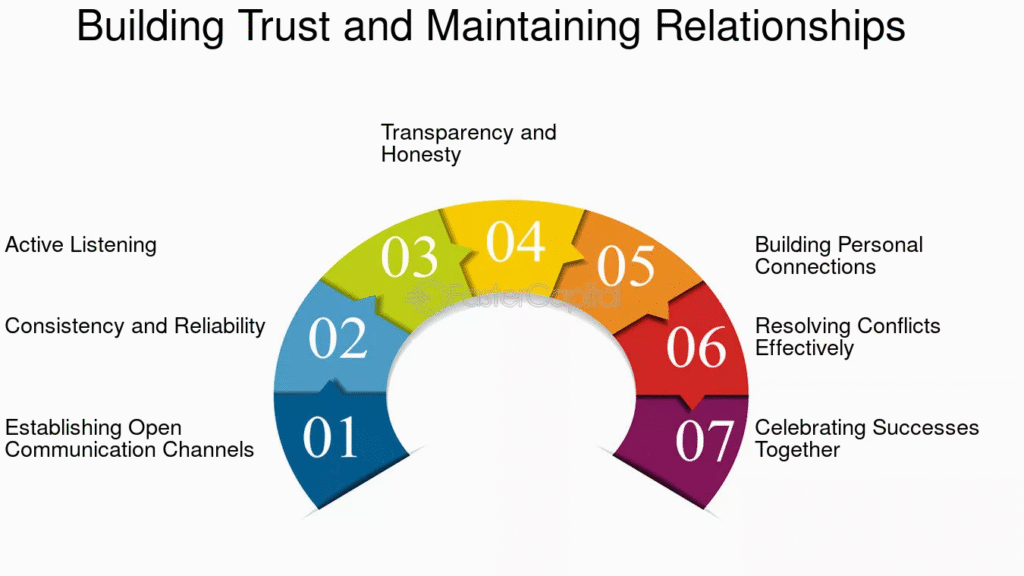

How to Build and Maintain a Trusting Financial Relationship

Trust is not something that happens overnight—it is cultivated over time through consistent communication, transparency, and mutual respect. Whether you are just beginning your relationship with a financial advisor or you have been working with one for years, nurturing trust requires ongoing effort from both parties.

Here are key strategies to help you build and maintain a strong, trusting financial relationship that will support your long-term financial goals.

1. Set Clear Expectations from the Start

Before any money changes hands or advice is acted upon, it’s vital to establish clear expectations about roles, responsibilities, and services.

- Define Your Goals: Share your financial goals openly—whether it’s buying a home, saving for retirement, funding education, or estate planning. The advisor should understand what success looks like for you.

- Clarify the Advisor’s Role: Understand exactly what services the advisor will provide—investment management, tax planning, insurance advice, etc.

- Discuss Communication Preferences: Agree on how often and by what means you will communicate—email, phone calls, in-person meetings, or virtual sessions.

- Establish Boundaries: Make it clear what you are comfortable with regarding risk tolerance, investment styles, and involvement in decision-making.

Setting expectations upfront helps avoid misunderstandings and builds a foundation for open dialogue.

2. Communicate Regularly and Transparently

Frequent and open communication is the lifeblood of trust.

- Schedule Regular Check-ins: Quarterly or bi-annual meetings help you stay informed about your portfolio’s performance, upcoming opportunities, or changes in your financial plan.

- Be Honest About Your Situation: Life changes such as marriage, job loss, inheritance, or health issues can impact your financial goals. Share these changes promptly.

- Ask Questions: No question is too small or too basic. A good advisor welcomes your inquiries and explains complex topics in clear terms.

- Provide Feedback: If something isn’t clear or you’re uncomfortable with an approach, voice your concerns immediately.

Regular communication ensures alignment and prevents surprises, reinforcing your confidence in the relationship.

3. Stay Informed and Educated About Your Finances

While your advisor is the expert, it’s important to be an active participant in your financial planning.

- Educate Yourself: Read books, follow trusted financial news sources, or take online courses. Understanding basic concepts helps you evaluate advice critically.

- Review Statements and Reports: Regularly review account statements, fee disclosures, and portfolio summaries.

- Stay Aware of Market Conditions: Awareness of broader economic trends can help you understand the context of your investments.

- Understand Your Plan: Make sure you grasp the rationale behind your financial strategy and feel comfortable with the risks and opportunities.

Being informed strengthens your confidence and ability to collaborate effectively with your advisor.

4. Review Your Portfolio and Financial Plan Periodically

Your financial needs and the market landscape change over time, so periodic reviews are essential.

- Assess Performance: Evaluate whether your investments are meeting your goals and if your risk exposure remains appropriate.

- Adjust for Life Changes: Update your plan to reflect new circumstances such as marriage, children, career changes, or approaching retirement.

- Rebalance Your Portfolio: To maintain your desired asset allocation, periodic rebalancing may be necessary.

- Evaluate Fees and Services: Ensure the costs you’re paying remain reasonable and that the services provided justify the fees.

Regular reviews foster transparency and allow you to make informed adjustments as needed.

5. Don’t Hesitate to Change Advisors if Trust Erodes

No matter how careful your selection, not every relationship will remain healthy or productive.

- Recognize Warning Signs: Poor communication, lack of transparency, missed promises, or unethical behavior are red flags.

- Trust Your Instincts: If you consistently feel uncomfortable, pressured, or ignored, it’s okay to seek someone better suited to your needs.

- Take Action Early: Changing advisors can be easier than you think, and waiting too long may cost you.

- Maintain Professionalism: When transitioning, ensure your assets and information are transferred securely and smoothly.

Remember, your financial future is paramount. A trusted advisor relationship should be a source of confidence and support—not stress.

6. Foster Mutual Respect and Professionalism

Trust grows from mutual respect. Treat your advisor as a partner and expect professionalism in return.

- Be Transparent: Share all relevant financial information openly.

- Respect Their Expertise: Value their knowledge, but always feel empowered to ask questions or seek second opinions.

- Honor Commitments: Keep scheduled meetings and respond timely to requests for information.

- Expect Professional Conduct: Your advisor should uphold confidentiality, honesty, and ethical standards.

A respectful, professional relationship builds strong, lasting trust.

7. Use Technology to Enhance Communication and Transparency

Modern tools can help maintain transparency and keep you connected.

- Secure Portals: Many advisors provide online portals where you can track your investments in real time.

- Regular Reports: Automated reports and alerts help you stay informed without waiting for meetings.

- Virtual Meetings: Convenient video calls can supplement in-person visits, especially during busy times.

- Educational Resources: Some firms offer webinars, newsletters, and workshops to keep clients informed.

Who SWho Should You Trust?

Choosing who to trust with your financial future is a deeply personal and consequential decision. Your financial advisor or planner will play a pivotal role in shaping your financial trajectory, helping you navigate uncertainties, and achieving your long-term goals. Therefore, the criteria for trustworthiness must be rigorous, clear, and based on tangible qualities and qualifications.

1. Holds Recognized Credentials (CFP, CPA, CFA)

Credentials serve as a benchmark of expertise and commitment to professional standards. Among the many designations, some are particularly noteworthy:

- Certified Financial Planner (CFP®): This credential signifies that the advisor has completed rigorous education, passed comprehensive exams, and adheres to a strict code of ethics. CFPs are trained to provide holistic financial planning, covering investments, retirement, tax planning, insurance, and estate planning.

- Certified Public Accountant (CPA): While primarily focused on tax and accounting, CPAs with personal financial specialist (PFS) credentials are well-equipped to provide tax-efficient financial advice.

- Chartered Financial Analyst (CFA): CFAs are experts in investment management and portfolio analysis, ideal for clients seeking sophisticated investment strategies.

These credentials indicate that the professional has invested significant time and effort into mastering their craft and maintaining ongoing education, which is crucial in the ever-evolving financial landscape.

2. Acts as a Fiduciary, Prioritizing Your Interests

Trustworthy advisors are fiduciaries, legally and ethically bound to act in your best interests at all times. This means:

- They must avoid conflicts of interest or fully disclose them when unavoidable.

- Their advice is based on what benefits you, not on selling proprietary products or maximizing their commissions.

- They are transparent about how they make money, whether through fees or commissions.

An advisor who does not act as a fiduciary may prioritize their own gain, leading to suboptimal advice or products that are not ideal for your goals.

3. Is Transparent and Honest About Fees and Risks

Clear communication about fees is essential to trust. You should know:

- Exactly how much you will pay (hourly, flat fee, percentage of assets, commissions).

- What services are included for those fees.

- Whether there are any hidden charges, penalties, or additional costs.

Equally important is honesty about investment risks and realistic expectations. No advisor can guarantee returns, and the trustworthy ones will openly discuss market volatility and potential downsides.

4. Has Verifiable Experience and a Clean Record

Experience matters. A seasoned advisor has navigated different market cycles and can offer guidance based on real-world insights. You can verify experience and disciplinary history by:

- Checking regulatory databases like FINRA BrokerCheck or the SEC’s Investment Adviser Public Disclosure.

- Asking the advisor for client references or testimonials.

- Researching any complaints, lawsuits, or regulatory actions.

A clean professional record is a strong indicator of ethical behavior and client satisfaction.

5. Communicates Clearly and Respects Your Goals

A trusted advisor listens carefully to understand your unique financial situation, goals, and risk tolerance. They communicate in a way that is:

- Clear and jargon-free

- Patient and willing to answer your questions

- Respectful of your values and preferences

They don’t push products or decisions but instead educate you, empowering you to make informed choices.

6. Charges Reasonable Fees Aligned with Services

The cost of advice should be fair and transparent relative to the complexity of services provided. While cheaper isn’t always better, exorbitant fees don’t guarantee better results. Trusted advisors structure fees so that:

- You understand what you’re paying for.

- Fees are justified by the value and outcomes of their services.

- There is alignment between advisor incentives and your success.

7. Makes You Feel Comfortable and Confident

Trust has an emotional component. You should feel confident that your advisor is not just competent but also genuinely cares about your financial well-being. You should:

- Feel comfortable sharing personal information.

- Sense honesty and integrity in their interactions.

- Have confidence that they will stand by you during market ups and downs.

If you don’t feel this rapport and trust early on, it’s okay to keep looking until you find the right match.

Your Financial Future is Too Important for Anything Less

Entrusting someone with your financial future is a significant step that demands careful consideration. The advisor or institution you choose should meet these stringent standards because your financial security, peace of mind, and ability to meet life’s goals depend on it.

Remember, it’s not just about finding the most knowledgeable person but finding the right person—someone who aligns with your values, understands your goals, and acts with your best interests at heart.

Also Read:- What Can a Financial Planner Do That You Can’t?

Conclusion

Choosing who to trust with your financial future is a decision that requires careful thought, research, and discernment. Your financial well-being depends heavily on the expertise, ethics, and commitment of the person or institution you select.

By understanding the types of financial professionals, the importance of fiduciary duty, the necessity of transparent communication, and the value of credentials and experience, you can make an informed decision. Remember, trust is earned through consistent honesty, competence, and alignment with your personal goals.

Ultimately, trust your instincts and take the time to vet candidates thoroughly. Your financial future deserves nothing less than the best guidance available.

FAQs

1. What is a fiduciary, and why is it important?

A fiduciary is a financial professional legally required to act in your best interests. This legal duty ensures advice is unbiased and focused on your financial well-being rather than the advisor’s profit.

2. How can I verify if a financial advisor is trustworthy?

Check credentials through official databases (CFP Board, FINRA BrokerCheck, SEC Investment Adviser Public Disclosure). Ask for references, read reviews, and interview multiple advisors.

3. Should I trust a financial advisor who works on commission?

Commission-based advisors may have conflicts of interest, as they earn money from product sales. Fee-only fiduciaries often provide more impartial advice.

4. Can I trust robo-advisors with my financial future?

Robo-advisors are generally trustworthy for simple investment management but lack the personalized planning and human judgment for complex financial situations.

5. What qualifications should I look for in a financial planner?

Look for CFP certification, experience, fiduciary status, and good reviews. The CFP designation is widely regarded as a hallmark of competency and ethics.

6. How often should I meet with my financial advisor?

At minimum, annually. More frequent meetings may be necessary depending on life changes or market volatility.

7. What questions should I ask before hiring a financial advisor?

Ask about their fiduciary status, fees, experience, client base, investment philosophy, and how they handle conflicts of interest.